This article originally appeared on BBC.com and was written by Kevin Peachey, Personal Finance Reporter.

Consumers spent more money on credit cards with UK retailers last year than they did in cash, a retailers’ trade body has said.

Debit cards were the most popular, but falling cash use pushed notes and coins down to third place, the British Retail Consortium (BRC) said.

Cash accounted for just over £1 in every £5 spent with UK shops.

The BRC argued that rising costs faced by retailers to process card payments could push up prices.

Credit and charge cards accounted for £82bn, or 22%, of retail sales last year – outstripping cash (£78bn) for the first time, according to the BRC, which has been running its payments survey for 20 years. Spending on debit cards totalled £216bn.

Cash was still used more frequently than credit cards, but the typical transaction using notes and coins was worth over £20 less than the average credit card payment of £31.54.

Andrew Cregan, policy adviser at the BRC, said that falling cash use and growth of online shopping were both factors in the shift.

He echoed concerns that any move to a totally cashless society could leave millions of people in the lurch. Without cash, it would be harder to leave tips or give to the homeless.

Vulnerable people, such as those with physical or mental health problems, who find it hard to use digital services, people who have been bankrupt, or those who use cash as a lifeline when in difficult or abusive relationships, could also be severely affected.

However, the BRC’s main concern for its members – the retailers – was the cost of accepting card payments.

The average cost faced by a retailer for a debit card transaction was 6.23p, rising to 18.19p for credit or charge cards, compared with 1.66p for cash, the BRC said.

Mr Cregan said about a third of the cost on cards was the so-called scheme fee charged by card companies such as Visa and Mastercard, and that cost had been rising sharply.

“Without action [from government], we will see businesses put under further pressure and it will be consumers who are forced to pay the price,” he said.

Cash machine decline

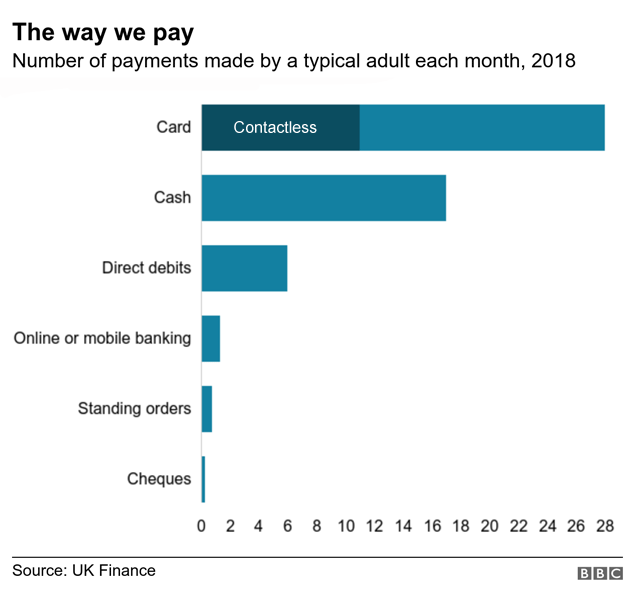

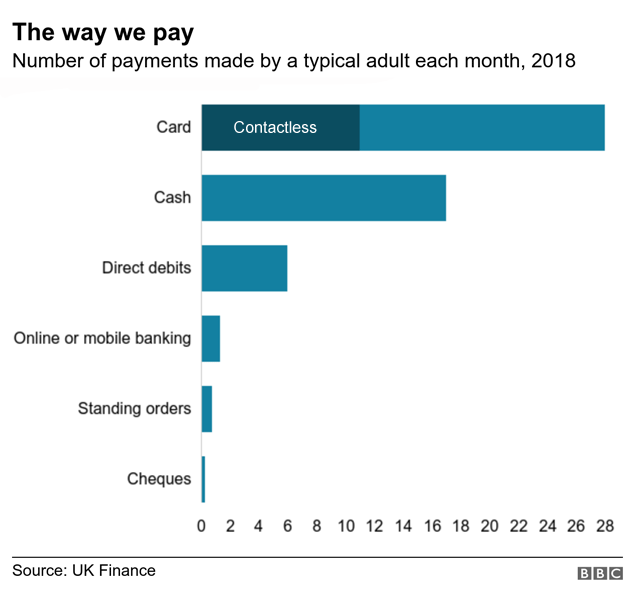

Earlier this year, a survey by banking trade body UK Finance also showed the dominance of cards among today’s consumers.

An independent report on Access to Cash called for a guarantee, so people can get hold of cash if they need it.

It wants to see an independent body, funded by the banks, to be set up that would step in if local communities were running short of access to cash in shops and ATMs.

On Wednesday, consumer group Which? said that free-to-use cash machines were disappearing quicker in deprived areas than in affluent ones.

Consumers spent more money on credit cards with UK retailers last year than they did in cash, a retailers’ trade body has said.

Debit cards were the most popular, but falling cash use pushed notes and coins down to third place, the British Retail Consortium (BRC) said.

Cash accounted for just over £1 in every £5 spent with UK shops.

The BRC argued that rising costs faced by retailers to process card payments could push up prices.

Credit and charge cards accounted for £82bn, or 22%, of retail sales last year – outstripping cash (£78bn) for the first time, according to the BRC, which has been running its payments survey for 20 years. Spending on debit cards totalled £216bn.

Cash was still used more frequently than credit cards, but the typical transaction using notes and coins was worth over £20 less than the average credit card payment of £31.54.

Andrew Cregan, policy adviser at the BRC, said that falling cash use and growth of online shopping were both factors in the shift.

He echoed concerns that any move to a totally cashless society could leave millions of people in the lurch. Without cash, it would be harder to leave tips or give to the homeless.

Vulnerable people, such as those with physical or mental health problems, who find it hard to use digital services, people who have been bankrupt, or those who use cash as a lifeline when in difficult or abusive relationships, could also be severely affected.

However, the BRC’s main concern for its members – the retailers – was the cost of accepting card payments.

The average cost faced by a retailer for a debit card transaction was 6.23p, rising to 18.19p for credit or charge cards, compared with 1.66p for cash, the BRC said.

Mr Cregan said about a third of the cost on cards was the so-called scheme fee charged by card companies such as Visa and Mastercard, and that cost had been rising sharply.

“Without action [from government], we will see businesses put under further pressure and it will be consumers who are forced to pay the price,” he said.

Cash machine decline

Earlier this year, a survey by banking trade body UK Finance also showed the dominance of cards among today’s consumers.

An independent report on Access to Cash called for a guarantee, so people can get hold of cash if they need it.

It wants to see an independent body, funded by the banks, to be set up that would step in if local communities were running short of access to cash in shops and ATMs.

On Wednesday, consumer group Which? said that free-to-use cash machines were disappearing quicker in deprived areas than in affluent ones.